The Initial Public Offering (IPO) of Ramdevbaba Solvent is causing quite a buzz in the investment community. As potential investors consider taking a stake in the company, one term that they come across is Grey Market Premium (GMP). This article aims to provide a comprehensive analysis of the Ramdevbaba Solvent IPO, including an explanation of GMP, the company’s financial performance, strengths, potential risks, and an investor’s perspective.

Understanding Ramdevbaba Solvent IPO

Ramdevbaba Solvent Pvt. Ltd. is a leading manufacturer of edible oils in India, with a strong presence in the market for over a decade. The company has decided to go public by issuing an IPO to raise funds for expansion and growth opportunities. Investors are keen to assess the company’s performance, future prospects, and the potential returns on investment.

What is Grey Market Premium (GMP)?

Grey Market Premium (GMP) is the premium at which the shares of a company are trading in the unofficial market before they get listed on the stock exchange. It indicates the demand for the shares and investor sentiment towards the IPO. A positive GMP suggests high demand, while a negative GMP indicates a lack of interest or concerns about the IPO.

Investors often look at GMP to gauge the potential listing price of the shares and make informed decisions about subscribing to the IPO. A high GMP does not guarantee profits, as the actual listing price may differ, but it provides insights into market expectations and investor confidence in the company.

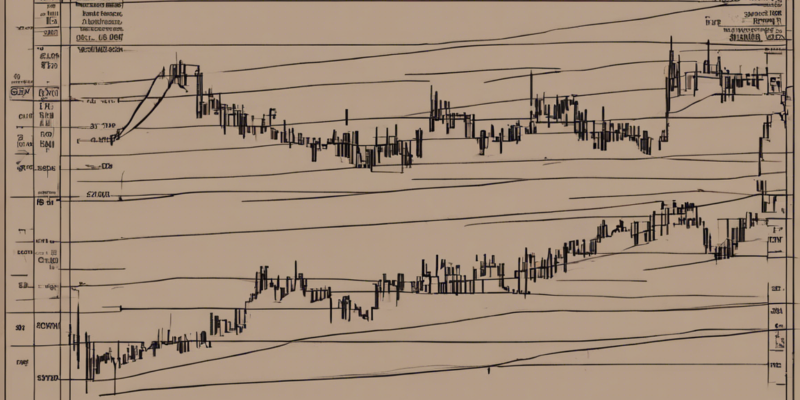

Financial Performance of Ramdevbaba Solvent

Before investing in any IPO, it is crucial to analyze the financial performance of the company. Ramdevbaba Solvent has shown consistent growth in revenue and profits over the past few years, indicating a stable business model and market position. Investors should delve into the company’s financial statements, profitability ratios, and cash flow metrics to assess its financial health and growth potential.

Strengths of Ramdevbaba Solvent

- Established Brand: Ramdevbaba Solvent has a strong brand presence in the edible oil industry, which can help drive customer loyalty and market share.

- Diverse Product Portfolio: The company offers a wide range of edible oils, catering to various consumer preferences and market segments.

- Distribution Network: Ramdevbaba Solvent has an extensive distribution network, ensuring widespread availability of its products across regions.

Potential Risks

- Competition: The edible oil industry is competitive, with many established players vying for market share. A saturated market can pose challenges for new entrants like Ramdevbaba Solvent.

- Regulatory Environment: Changes in government regulations or policies related to the edible oil industry can impact the company’s operations and profitability.

- Commodity Price Volatility: Fluctuations in raw material prices, such as soybean or palm oil, can affect the company’s margins and financial performance.

Investor’s Perspective

As an investor considering the Ramdevbaba Solvent IPO, it is essential to conduct thorough research and due diligence before making a decision. Evaluate the company’s fundamentals, competitive position, industry trends, and growth prospects to determine if it aligns with your investment goals and risk appetite. Consider consulting with financial advisors or analysts for insights and recommendations based on your investment profile.

Frequently Asked Questions (FAQs) about Ramdevbaba Solvent IPO

- What is the minimum investment requirement for the Ramdevbaba Solvent IPO?

-

The minimum investment amount for the IPO is typically specified in the offer document. Investors should check the prospectus for this information.

-

How can I apply for the Ramdevbaba Solvent IPO?

-

Investors can apply for the IPO through their demat accounts with registered brokers or through the online platform provided by the company or lead managers.

-

What factors should I consider before investing in the Ramdevbaba Solvent IPO?

-

Factors to consider include the company’s financial performance, industry outlook, competition, regulatory environment, and potential risks associated with the business.

-

Is Grey Market Premium (GMP) a reliable indicator for investing in an IPO?

-

While GMP can provide insights into market sentiment, it should not be the sole basis for investment decisions. Investors should conduct thorough research and analysis before investing in any IPO.

-

What are the lock-in periods for shares purchased through the Ramdevbaba Solvent IPO?

- The lock-in periods for shares allotted in an IPO are typically mentioned in the offer document. Investors should be aware of these restrictions before investing.

In conclusion, the decision to invest in the Ramdevbaba Solvent IPO should be based on a careful evaluation of the company’s financial performance, strengths, risks, and market dynamics. By staying informed and seeking expert advice, investors can make informed decisions to maximize returns and manage risks effectively.